Angelica Garcia

30 Août 2020

However, the Opposition, led by the Congress, demanded that the GST Bill be again sent back for review to the Select Committee of the Rajya Sabha due to disagreements on several statements in the Bill relating to taxation.In February 2015, Jaitley set another deadline of 1 April 2017 to implement GST.With the consequential dissolution of the 15th Lok Sabha, the GST Bill.The receiver of the goods is eligible for Input Tax Credit, while the unregistered dealer is not.It is a comprehensive, multistage, destination based tax: comprehensive because it has subsumed almost all the indirect taxes except a few state taxes.Business Standard.For the legislation introducing this tax, see One Hundred and First Amendment of the Constitution of India.By using this site, you agree to the Terms of Use and Privacy Policy. EN SAVOIR PLUS >>>

Image source: image.slidesharecdn.com?cb=1247102031

Progressive Taxes: What's the Difference.The business adds the GST to the price of the product, and?a customer who buys the product?pays the sales price plus the GST.In this case, a consumer?s receipt will clearly have the GST and PST rate that was applied to his or her purchase value.The Increasing Importance of the Reserve Bank of India.The main objective of incorporating the GST was to eliminate tax on tax or. or Canada: Which Country Is Best to Call Home.These countries tax virtually everything at a single rate.Do Canadians Really Pay More Taxes Than Americans. 1 in tax for Rs.The GST portion is collected by the business or seller and forwarded to the government.Compared to a unified GST economy where tax is collected by the federal government and then distributed to the states, in a dual system, the federal GST is applied in addition to the state sales tax.S.The GST is usually taxed as a single rate across a nation.In effect, GST provides revenue for the government.g.A value-added tax (VAT) is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale.

Image source: image.slidesharecdn.com?cb=1496505201

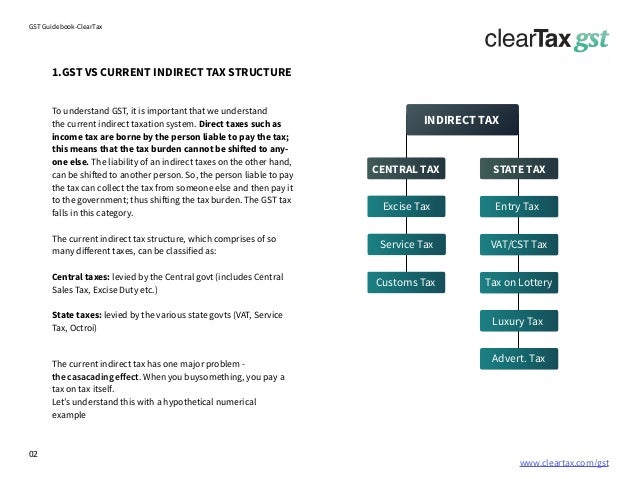

The Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption

It overcomes limitations of the previous indirect tax structure.Such multiplicity of taxes gave way to multiple taxable events.It is levied on value added to goods as well as services at each stage of the supply chain. Ltd.B on selling goods to C collects GST of Rs 39,600 from C.Since then, the journey of GST has been a long one with its own set of peaks and troughs.Customs and GST are the major indirect taxes in India.It does away with the cascading effect of taxes.Thus, B pays tax on the amount of value added to the goods which is worth Rs 20,000.Thus, such a tax structure escalated the cost.Currently, there are 31 legislations governing and regulating GST law Instead of single or dual rate GST system, there are 7 standard tax rates as well as multiple rates of CESS Hurried implementation of GST which has lead to confusion among professionals and businesses Increased cost for businesses as they either have to update current software or invest in new one You May Also Read GST Payment Process: How To Pay GST Online? Goods and Services Tax.

It is a simple procedure that can be followed even by individuals with minimal technical know-how.Andaman and Nicobar Islands, Daman and Diu, Dadra and Nagar Haveli, Lakshadweep, and Chandigarh.The government is aiming to collect Rs.4,100 crore in case of selling of phones.70 reduced.The implementation of GST has ensured that all businesses pay a uniform tax for the supply of goods and services.10 lakh were exempt from Service Tax.According to a report, the consolidated revenue gap could range between Rs.The amount of compensation that is provided will be based on an agreed formula.The focus now is on system-generated intelligence and system-based analytical tools to prevent GST evasions in future.It is also important to note that service providers who generated a turnover of up to Rs.1,000 are taxed at 5% followed by leather and non-woven fabrics taxed at 12%. Goods & Services Tax GST.

56761.56.34.99

Get the latest KPMG thought leadership directly to your individual personalised dashboard.State GST and Central GST rates are the same.TP controversies and dispute resolution management.In addition to the exceptional impact GST has on the economic growth of the country and the way business is done in India, it has achieved the following.This demonstrates the true federal character of the Indian fiscal system.Click anywhere on the bar, to resend verification email.Our privacy policy has been updated since the last time you logged in.Find out how KPMG's expertise can help you and your company.It has the potential to improve cash flow, pricing, working capital, supply chain and fine tune IT systems and hence provide an opportunity to transform businesses.We want to make sure you're kept up to date. What is Goods and Services Tax.

Image source: image.slidesharecdn.com?cb=1498828548

The Central Government will have the power to levy excise duty in addition to GST, on tobacco and tobacco products.In 2003, the Central Government formed a taskforce on Fiscal Responsibility and Budget Management, which in 2004 recommended GST to replace the existing tax regime by introducing a comprehensive tax on all goods and services replacing Central level VAT and State level VATs.In a recent meeting, the GST Council has decided that GST would be levied at four rates viz.The credit would be permitted to be utilised in the following manner:-.f.This shall be levied and collected by the Government of India and such tax shall be apportioned between the Union and the States in the manner as may be provided by Parliament by Law on the recommendation of the GST Council.The transfer of funds would be carried out on the basis of information contained in the returns filed by the taxpayers.It would also imply that the actual burden of indirect taxes on goods and services would be much more transparent to the consumer.

Image source: image.slidesharecdn.com?cb=1496923686

Thereafter, there has been a constant endeavor for the introduction of the GST in the country whose culmination has been the introduction of the Constitution (122nd Amendment) Bill in December, 2014.The genesis of the introduction of GST in the country was laid down in the historic Budget Speech of 28th February 2006, wherein the then Finance Minister laid down 1st April, 2010 as the date for the introduction of GST in the country

Goods and Services Tax is one of the greatest tax reforms of India. Here's everythig you need to know about what is GST in India..

GST - Goods and Services Tax as it is known in its expanded form, is an indirect tax structure that has replaced several indirect taxes in the country. Know about Good and service tax law, GST Registration in India..

Goods and Services Tax (GST), one of the most radical tax reforms in the history of Indian economy, has been effective from 1 July 2017.